36+ Schedule to pay off credit card debt

Before getting into how to pay off credit card debt lets start by explaining what it is. In order to pay off 1000 in credit card debt within 36 months you need to pay 36 per month assuming an APR of 18.

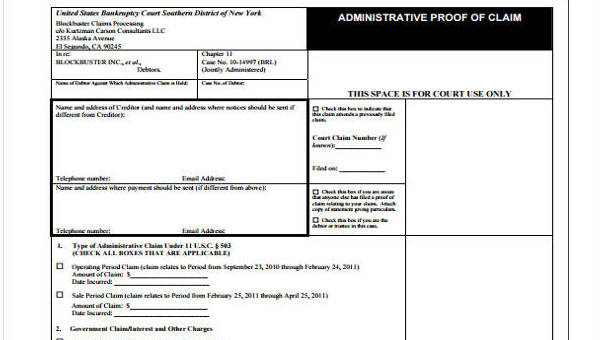

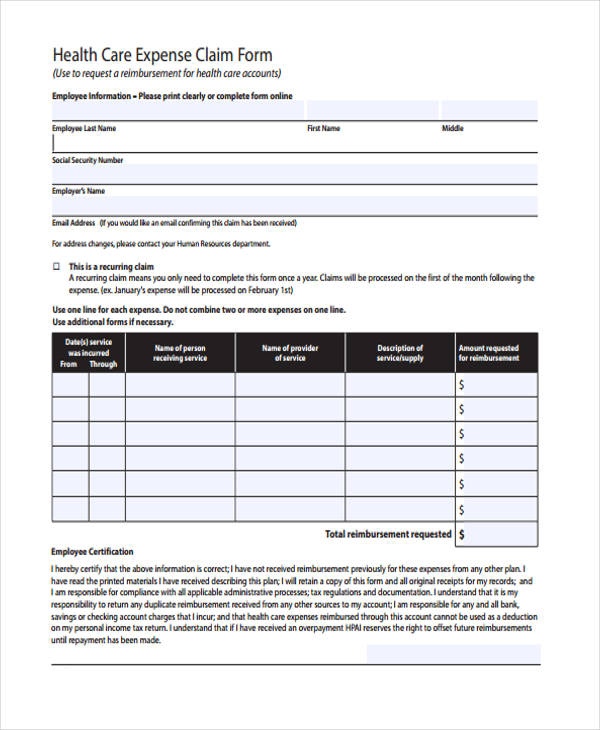

Free 36 Claim Form Examples In Pdf Excel Ms Word

Financial Relief With Americor Funding.

. The avalanche method and the snowball method. There are 2 different debt payment strategies. Track Debts You Have and Which to Pay Off First.

Apply for a Consultation. With the avalanche method you pay the balance with the highest. AFCC BBB A Accredited.

Get a Savings Estimate. Americor Will Find the Best Solution for You. While you would incur 304 in interest charges during.

2 Decide in what order you want to pay off your debt. Ad Outsmart credit card companies. Find Step-by-Step Assistance to Pay Your Debts.

Wiping away credit card debt should be a top priority in 2022 and the faster you do it the more you will save. Example of a Credit Card with Different Payoff Length. Ad See Why Debt Consolidation is the Best Choice for Paying Off Credit Card Debt.

Ad BBB A Accredited Companies. Ad Compare 2022s Top 5 Debt Relief Options. In order to pay off 7000 in credit card debt within 36 months you need to pay 254 per month assuming an APR of 18.

The avalanche method or the snowball method. One Lower Monthly Payment. More than 41 percent of American households carry credit card debt with an average balance of almost 6000 according to 2019 figuresIf youve become accustomed to.

Ad Compare 2022s Top 5 Debt Relief Options. One Low Monthly Payment. With the debt avalanche you would focus your biggest payment on the debt with.

Americans owe 104 trillion in revolving credit card debt as of the fourth quarter of 2021 according to the. If youre carrying debt on your credit card know that youre not alone. When you use a credit card youre essentially taking out a small short-term loan.

There are two methods when it comes to paying off your credit card debt. Ad One Low Monthly Payment. Here are eight ways to pay down debt quickly.

Our Certified Debt Counselors Help You Achieve Financial Freedom. Pay More than the. When thinking about budgeting you might consider the 503020 rule to help you.

There are several different ways you can tackle your credit card debt. Ad Get Assistance Managing Which Debts to Pay First and How Much to Pay. Heres a quick summary of your.

Ad Avoid Bankruptcy and Revive Your Credit. And depending on your credit situation and budget some may be better than others. Credit card balances were 71 billion higher in the first quarter of 2022 than in Q1 2021 according to a report by the Federal.

See If You Qualify. Get Your Free Quote Today. Many Americans struggle with credit card debt.

Having a budget can help prevent large amounts of credit card debt. Get Your Free Quote Today. Rated 1 by Top Consumer Reviews.

While you would incur 2127 in interest charges. One Lower Monthly Payment. Lets say you have four credit cards with APRs of 2299 1999 1299 and 1199.

See How Much You Could Save On Your Debt. Apply for Financial Freedom. Heres a breakdown of how each debt.

Unbiased Reviews Ratings. Figure out your budget. Consolidating credit card debt involves paying off your existing debt with a new credit card or personal loan preferably with better terms.

Ad Get Instantly Matched With The Ideal Credit Card Debt Consolidation for You. Example 12 Months Example 36 Months Monthly Payment. See How Much You Could Save On Your Debt.

Compare Online The Best Credit Card Debt Consolidation Loans. Get a Free Quote from a Certified Debt Consultant. Start by listing out all your debt account.

When you are ready to pay off your credit card debt there are a few different strategies that can reduce your credit card debt and bring balance to your financial well-being. To nix your credit card debt use our calculator and follow our four steps below. Tally can get you to 0 credit card debt faster.

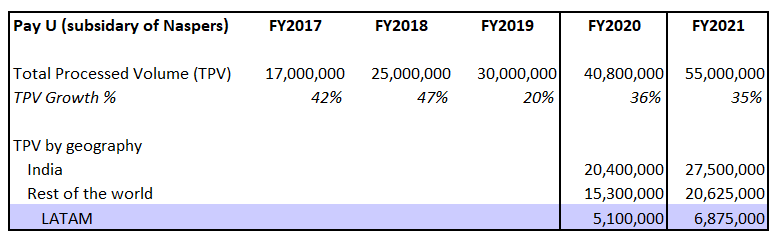

Deep Dive Writeup Dlo By Jonah Lupton

Trading Card Retro Style Baseball Card Template Trading Card Template Cards

4 Years Ago I Had No Savings In Fact I Had A Small Outstanding Debt In Collections Then I Started Working At A Bank And It Really Put My Butt In Gear

Personal Value Proposition Statement Letter Examples Letter Example Value Proposition Personal Values

Personal Value Proposition Statement Letter Examples Letter Example Value Proposition Personal Values

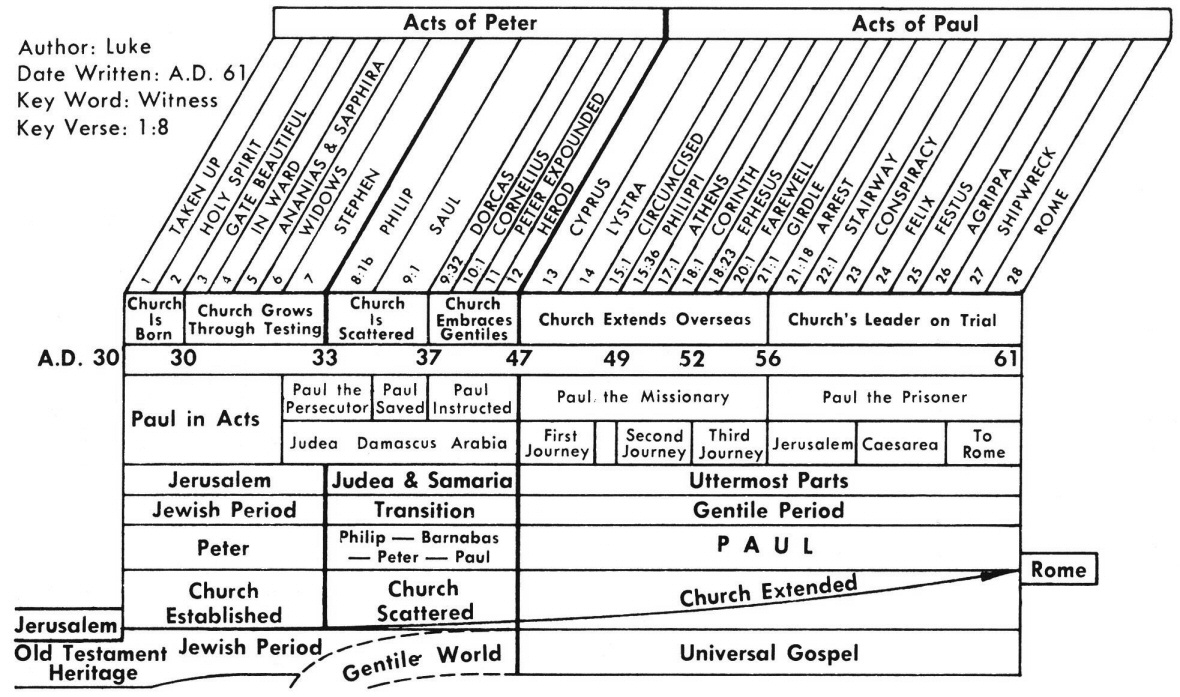

Acts 8 Commentary Precept Austin

2

Free 36 Claim Form Examples In Pdf Excel Ms Word

Personal Finance For Millenials Personal Finance Personal Finance Advice Personal Finance Organization

Generating Lasting Wealth Springerlink

Pin Em Floral Invitations Template

2

14 Retirement Letter Templates Word Pdf Letter Template Word Letter To Teacher Retirement Letter To Employer

36 How To Better Budgeting Bullet Journal List Money Saving Tips Best Money Saving Tips Saving Tips

15 Ways I Paid Off 80 000 Of Debt In 18 Months Classy Career Girl Paying Off Credit Cards Finance Blog Paying Off Student Loans

4 4 Stiga Skjalfti I Bardarbunguoskju Earthquake Iceland Map

Pin Em Floral Invitations Template